Corporate Taxes

- Disclaimer: This author

- is not anti-government

- believes government plays a crucial role in a well-ordered society

- believes taxes are necessary to achieve that end

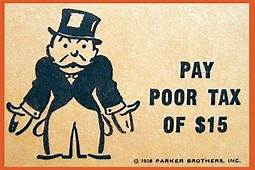

- Corporate taxes are a misnomer. It took me hearing this a few times before it sunk in, but in reality, corporations never pay taxes. We pay them.

- As far as those who manage corporations are concerned, what are corporate taxes? Well, taxes are just another expense,

like labor, material cost, office expenses, etc., that get factored into the price of their goods and services and we pay them when we purchase their products.

- By taxing corporations, the government turns them into tax collection agencies on their behalf. It's really quite brilliant,

don't you think? It's a way of taxing us without us even realizing it.

- Think about it. If the government raises gasoline taxes 2 cents per gallon, what happens? The price of gas goes

up 2 cents and we pay it at the pump. The oil companies, after collecting the money from us, hand over bags of money

to the government (under the table because we don't see it). Think of it as kinda the old shell game. Now, you see it.

Now, you don't. No, government is not taxing "Big Oil" -- and if you think so, the joke (along with the tax increase) is on you.

- The same principle applies if the government raises the corporate tax rate. The increase just gets added

to the price of whatever they're selling -- and we pay it. A corporation is just an entity that exists on paper

(or a document stored in a computer somewhere) and can not pay taxes. Only people who have money can pay taxes.

Let me (attempt to) explain.

- If you own a home and your local government raises property taxes, your local officials can stand outside your house with their hands out until doomsday and never collect a penny. Why? Because your home and property, like corporations, really only exist on paper. You have to pay the property tax. Why? Because property (like corporations) can never pay taxes. Only people who have money can pay taxes.

- If you own a flower shop and the taxes on your business are increased, what happens? As the business owner, you have several options.

- You can cut cost. (Easier said than done, especially if you've already cut expenses as best you can.)

- You can reduce your labor expenses with layoffs or reduced hours. (Easier said than done, especially if you're already operating with minimal staff. Workforce reductions certainly aren't good for your employees nor the local economy, and no business owner wants to reduce staff, which can lower customer service and satisfaction, because of increased costs.)

- You can increase prices. (That also is tricky. It wouldn't take many customers deciding to buy their flowers at Walmart, etc. to drive you out of business.)

- You can absorb the cost yourself. Translation: you take a pay cut. (Easier said than done, especially if you are already barely making enough to stay afloat. You still have bills to pay, food to put on the table, etc.)

- Most states also have corportate and income taxes (along with innumerable other taxes and fees). So, we get taxed:

- when we earn an income

- when purchasing a product or service via sales tax

- when we pay what I call the "hidden tax" of paying the corporate tax businesses have to pay for the privilege of doing business in the U.S. and your state that are included in the price of the goods and services we purchase.

- I'll say it one more time. Corporations never pay taxes. We pay them.

The higher the corporate tax rate, the more something costs, the more we pay --

| and that's the truth. |

|

|